Recognizing that responding to climate change is an important management issue, the Nitto Group has strategically included such responses in its management agenda and announced its support for the recommendations by the Task Force on Climate-related Financial Disclosures (TCFD) in May 2022. After announcing our support, every year, we assess the impact that climate-change-related risks and opportunities may have on our business and make revisions as necessary. In fiscal 2024, we enhanced our governance and risk management systems related to climate change, considered countermeasures, and reviewed our targets, taking into account the impact on our business.

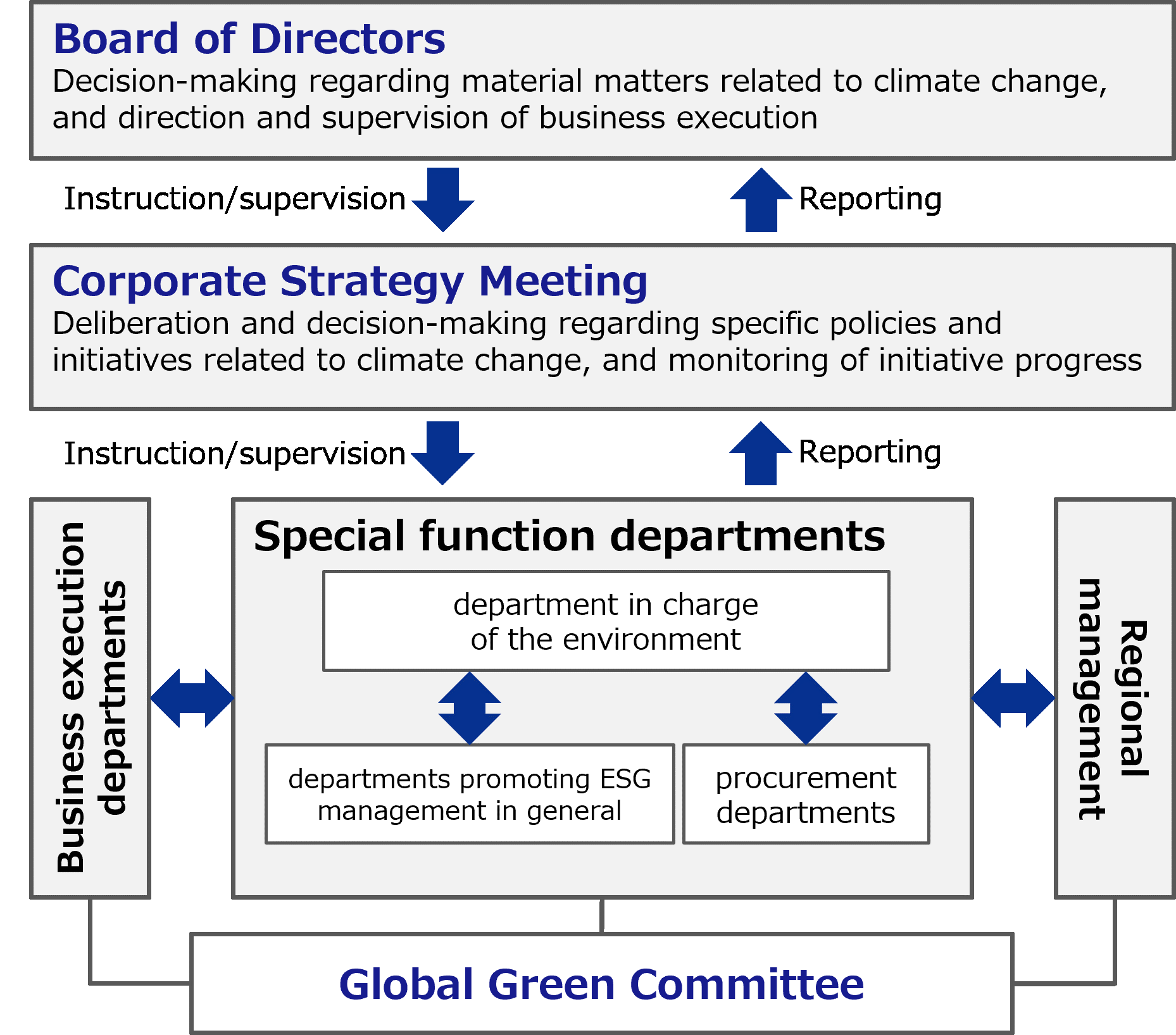

The Nitto Group has set “Realizing a decarbonized society” as one of its material issues for sustainability and is strengthening its efforts to combat climate change. To solve environmental issues including climate change, the Group is working to develop and promote short- to mid-term and long-term strategies by establishing a governance system where President-Director & CEO is appointed as the superintendent, and the Corporate Strategy Meeting plays the central role under the direction and supervision of the Board of Directors.

In addition, in order to increase the effectiveness of environmental initiatives including climate change response, the Group has established the Global Green Committee led by the Vice President in charge of promoting climate change-related issues and strengthen cross-organizational coalitions while examining strategies and implementing and promoting countermeasures against the issues. The Nitto Group's governance structure is as follows:

The Nitto Group places environmental, social, and governance (ESG) at the core of its management. As such, rather than establishing a general sustainability committee or ESG committee, we use the Corporate Strategy Meeting, chaired by the President-Director & CEO and comprising of all Vice Presidents, as a platform to discuss the promotion of ESG management. This enables us to incorporate ESG into management in a swift and appropriate manner, and to achieve governance that ensures higher feasibility by integrating the company’s sustainability and growth strategy.

The Board of Directors makes decisions on important matters, for instance, management policies, management indicators and targets related to the environment including climate change (future-financial targets), such as the mid-term management plan and support for external initiatives. Each quarter, it provides periodic directions, and conducts supervision, concerning the climate change targets (future-financial targets) of the mid-term management plan as well as the status of progress toward target achievement, and, as necessary, adds new items to the agenda if a material matter arises.

The Board of Directors is comprised of Directors who possess qualifications, knowledge, and experience related to sustainability, including climate change, and who thus impart it with a sustainable and greater supervision function.

Please see the section below for the skills of each Director.

As for Director remuneration, ESG items (future-financial targets regarded as material issues) have been included in the criteria for performance linked share-based remuneration (additional remuneration as an incentive for improving medium-term performance). The number of shares to be granted ranges from 0% to 150%, depending on the progress made toward achieving the key performance indicators of consolidated operating income, consolidated ROE, and ESG-related items (future-financial targets laid out in the mid-term management plan) at the end of the three-year period from the start of the performance evaluation period.

The Corporate Strategy Meeting, chaired by the President-Director and CEO, is responsible for deliberation and decision-making regarding specific policies and measures for action based on management policies and management indicators regarding the environment including climate change, as well as managing risks and opportunities and monitoring progress towards achieving targets on a monthly basis. It provides periodic reports––on a quarterly basis––to the Board of Directors on its deliberations and decisions and the progress of initiatives, and, as necessary, provides additional reports if a material matter arises. Additionally, to ensure that the matters deliberated and decided are promptly disseminated throughout the company, the Corporate Strategy Meeting comprises all Vice Presidents who are in charge of business execution departments, special function departments, and regional management.

We appoint the Vice President in charge of promoting environmental initiatives including climate change, and also have special function departments responsible for implementing those initiatives that serves as a department in charge of the environment. The department regularly assesses the risks and opportunities related to climate change, considers strategies (including transition plans), as well as executes and promotes measures to tackle climate change issues. The Vice President manages and supervises the results of these assessments, the details of their consideration, and their implementation and promotion.

In order to enhance the feasibility of climate change initiatives, we have established the Global Green Committee that is managed by the Vice President in charge of promoting climate change initiatives, aiming to strengthen cross-organizational cooperation among the various functional departments involved, including departments promoting ESG management in general, procurement departments, business execution departments, and regional management. The major activities of the Global Green Committee are as follows:

The progress of these initiatives is periodically reported to the Corporate Strategy Meeting primarily by the department in charge of the environment.

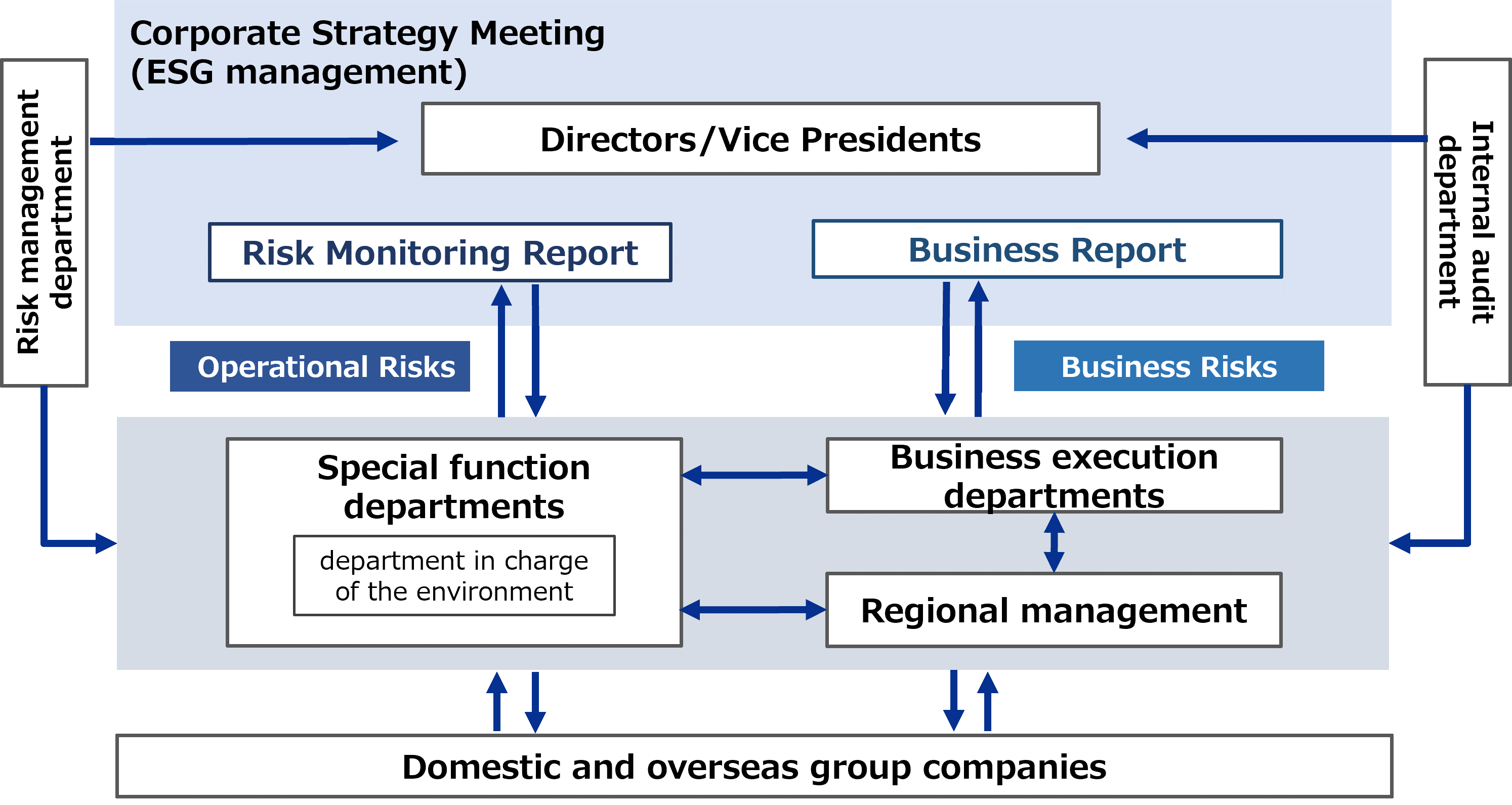

The Group appropriately manages key risks and opportunities related to climate change that management recognizes may significantly impact its business activities, and implements comprehensive management across the Group by combining them with other key risks that also significantly impact its business activities.

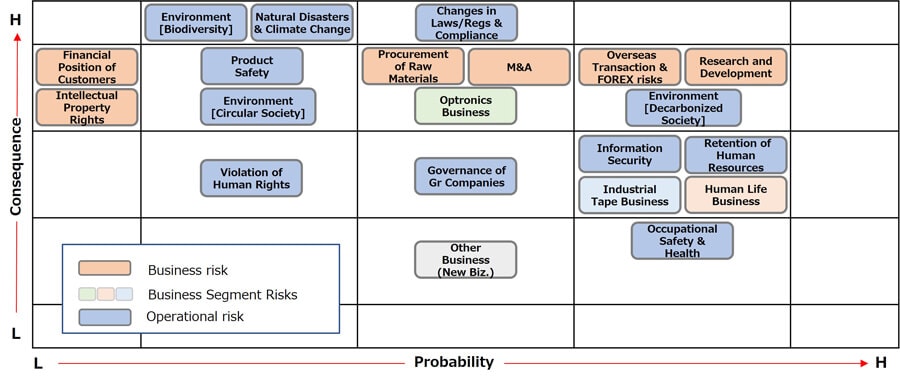

Regarding key risks and opportunities related to climate change in business activities, the Group understands the impact of changes in the internal and external environment; evaluates and identifies(selects) relative importance based on the “magnitude of impact” on business in the case of an incident and the “possibility of occurrence”; and determines the priority of the risks and opportunities.

We utilize scenario analysis to identify the risks and opportunities associated with the shift to a low-carbon economy that are expected due to climate change, as well as the risks of physical damage posed by factors such as extreme weather, for not only Nitto but the entire value chain stretching from our suppliers to customers, and then make a qualitative and quantitative assessment of the possible financial impacts.

The Nitto Group appropriately manages the identified major risks and opportunities associated with environment issues including climate change under the Risk Management Promotion System below.

The key risks and opportunities related to the environment issues including climate change will be monitored by business execution departments and regional managers in collaboration, while the department responsible for environmental issues will assume responsibility for managing them. Information regarding monitored risks and opportunities, together with information managed by other special function departments, will be reported and deliberated monthly at the Corporate Strategy Meeting, which consists of Directors and Vice Presidents. The results of the deliberation will be instantly communicated to related departments, and countermeasures against risks and measures for opportunities will be promptly taken to strengthen controls. The progress of the implementation and improvement will be again reported to and monitored at the Corporate Strategy Meeting to increase the effectiveness of the Group management.

At the end of the fiscal year, the department in charge of the environment, as the department responsible for the environment management, conducts a self-evaluation on the major risks and opportunities associated with the environment issues including climate change that were reported and reviewed in the Corporate Strategy Meeting in accordance with evaluation criteria such as the implementation structure establishment, controls and preventative measures implementation, and the occurrence of incidents as well as the responses to them. The department in charge of risk management evaluates the results of the self-evaluation from an independent viewpoint. Once this is approved by the Vice President in charge of risk management, it is reported to the Corporate Strategy Meeting and the Board of Directors as an independent evaluation.

As a group, we manage risks and opportunities related to the environment issues including climate change comprehensively by integrating them with other major risks that significantly impact our business operations. We assess the relative importance of individual risks by analyzing them using a graph with two axes––a vertical axis representing the “degree of impact” on our business in case of occurrence or manifestation, and a horizontal axis representing the “probability of occurrence”––and recognize the significance of climate change risks among group-wide risks. We categorize these group-wide risks into “business risks,” which are associated with our businesses, and “operational risks,” which can generate group-wide impact, and implement appropriate risk management on a group basis. The major group-wide risks in fiscal 2024 are as follows. Please see here for more details.

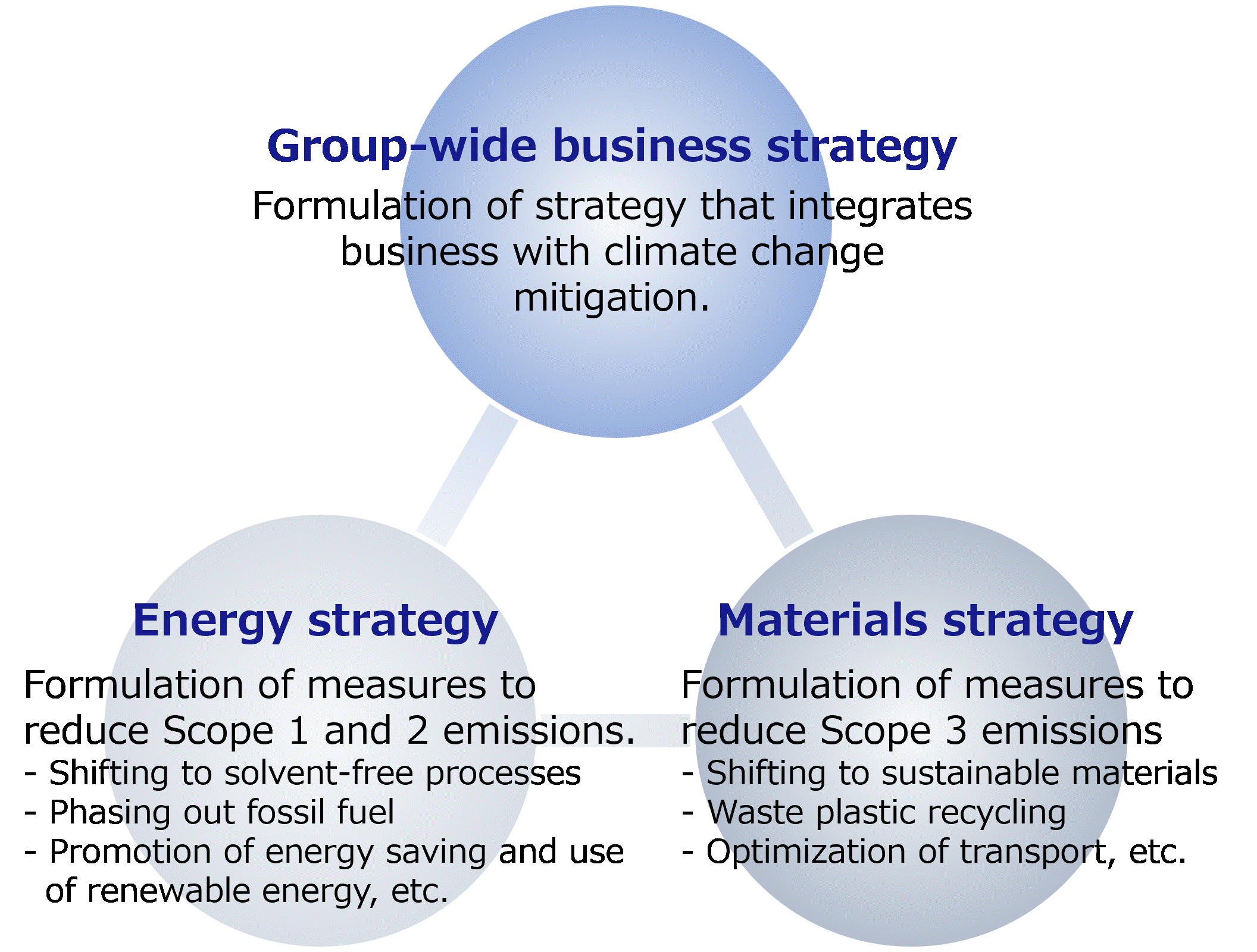

In line with external trends, as exemplified by the conclusion of the 2015 Paris Agreement and the Japanese government’s carbon-neutral declaration, the Group carried out a scenario analysis regarding transition risks and physical risks and opportunities expected due to climate change across the entire value chain, which includes not only the Group but also its suppliers and customers. The results of the scenario analysis have been incorporated into 2030 management indicators, including Nitto Group Carbon Neutral 2050, and into the mid-term management plan Nitto for Everyone 2025. The Group has promoted initiatives to remove solvents, save energy, use renewable energy, and create products that contribute to the environment, and confirmed that it would be able to minimize risks and maximize opportunities, and that the strategy would be useful.

To realize a decarbonized society, the Group recognizes measures against climate change as its material management issue and strategically incorporates them into its management.

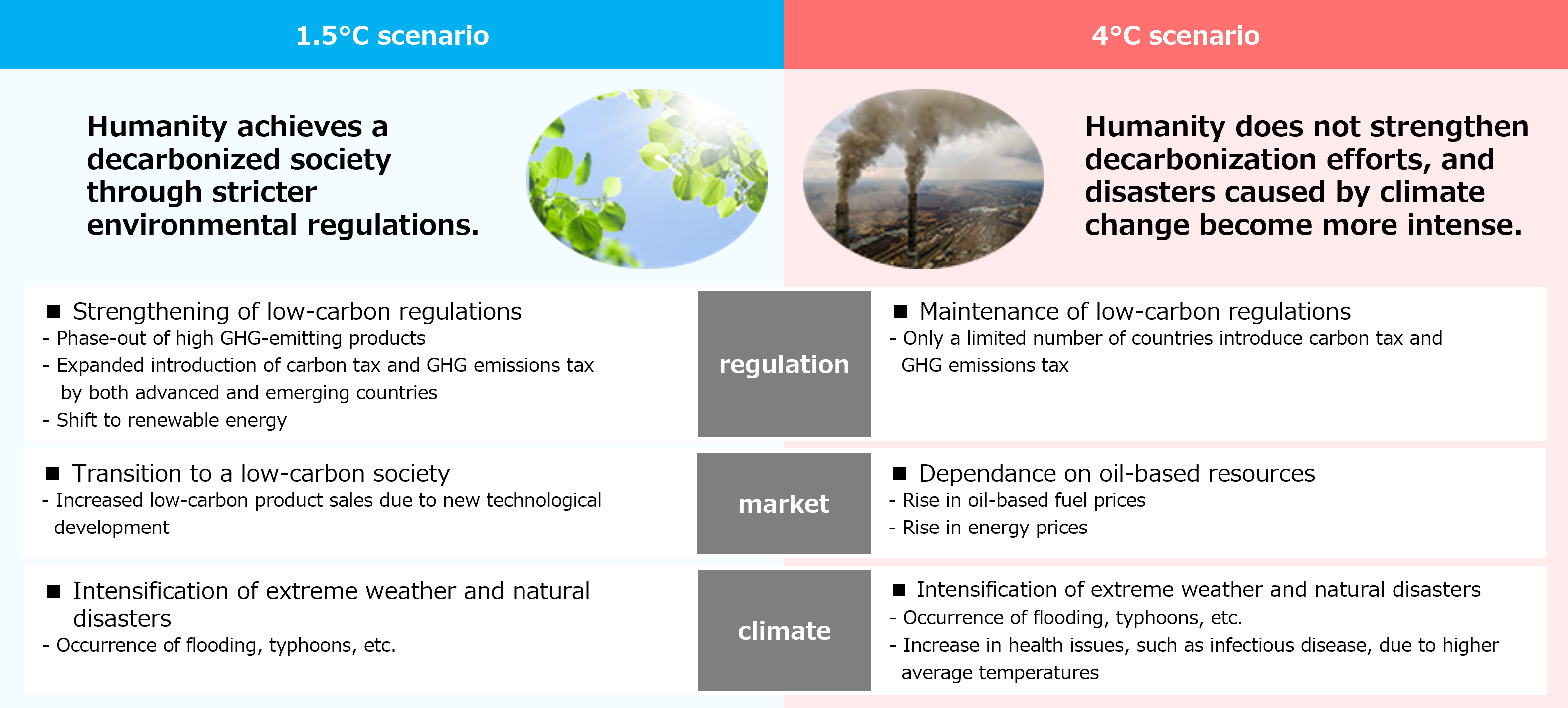

We forecast the impact that changes in the business environment caused by climate change may have on our businesses and management, and then create scenarios based on this. We consider the “1.5°C scenario,” under which the average global temperature does not exceed that of preindustrial times by more than 1.5°C by 2050, and the “4°C scenario,” under which the average global temperature is likely to exceed that of preindustrial times by 3.2 to 5.4°C by 2050.

These scenarios are created based on information published by the international organizations indicated below. The business environment assumed in each scenario is as follows.

We identify the risks and opportunities in the short term (less than three years), medium term (three to six years), and long term (six years or more) under the business environment assumed in the respective scenarios. The short-term and medium-term risks and opportunities are reflected in the mid-term management plan. For the long-term risks and opportunities, we conduct a financial quantitative analysis to identify the business impact (financial impact) in the event that the respective scenarios materialize. The business impacts in the long term is as follows.

| Type of risk/opportunity | Event | Assumed risks and opportunities | Impact calculation item | 1.5℃ | 4℃ | |||

|---|---|---|---|---|---|---|---|---|

| 2030 | 2050 | 2030 | 2050 | |||||

| Transition risks | Policy and laws and regulations | Strengthening of low carbon regulations | An increase in transition costs (raw material costs) to low GHG-emitting raw materials | Increased costs for switching to sustainable raw materials | Large | Large | ー | ー |

| A substantial increase in renewable energy procurement costs due to the spread of renewable energy | Increased costs for renewable energy procurement | Small | Small | ー | ー | |||

| An increase in capital expenditure (installation costs of renewable energy facilities) due to the spread of renewable energy | Increased capital investment costs due to introduction of renewable energy facilities | Small | Small | ー | ー | |||

| An increase in waste disposal costs due to stricter waste disposal regulations and standards. | (Quantification planned if the impact of waste disposal costs becomes measurable) | |||||||

| An increase in GHG emission price | An increase in taxation costs (operating costs) due to the increased introduction of carbon taxes and carbon levies | Increased operating costs due to increased tax obligations | Large | Large | Small | Medium | ||

| Technology | Transition to low carbon products due to investment in new technologies | A substantial increase in capital expenditures (installation costs of high-efficiency facilities) due to the development and introduction of high energy-efficient technologies | Increased capital investment costs due to introduction of high-efficiency facilities | Medium | Large | ー | ー | |

| Industry/market | A substantial increase in raw material prices | An increase in petroleum-derived raw materials procurement costs due to soaring fossil fuel prices | Increased procurement costs due to higher oil-based raw material prices | Medium | Large | Large | Large | |

| An increase in petroleum-derived raw material costs due to carbon taxes and other taxes in the upstream of the value chain passed on to raw materials | ||||||||

| Increase in transport costs due to higher fossil fuel prices. | (Quantification planned if the transport costs become identifiable) | |||||||

| An increase in energy prices due to soaring fossil fuel prices | Increased energy costs associated with fossil fuel prices | ー | ー | Medium | Medium | |||

| Physical risks | Acuteness | Occurrence of abnormal weather and natural disaster (acute) | Damage to the company’s buildings, facilities, infrastructure, etc., plant shutdowns, and lost opportunities (decrease in revenue) due to a flood, high tide, etc. | Damage to assets due to damage to or suspension of facilities and infrastructure | Medium | Medium | Medium | Large |

| Suspension of operation at the company’s plants, loss of opportunities (decrease in revenue) due to major suppliers being hit by a flood, high tide, etc. | Opportunity loss due to damage to or suspension of facilities and infrastructure | Small | Small | Small | Small | |||

| Chronic | Sea level rise | Suspension of Nitto plants due to flooding, etc. | (No relevant Nitto plants) | |||||

| Opportunities | Products/services | An increase in demand for low-carbon products(Change in preferences) | An increase in revenue of products contributing to the environment due to increased demand for recycled products | Increased sales from products contributing to the environment | Medium | Large | ー | ー |

| An increase in demand for medical-related products (response to infectious disease) | An increase in revenue of medical-related products due to an increase in health damage, such as infectious diseases due to rising average temperature | Increased sales from medical-related products | ー | ー | Large | Large | ||

| Monetary impact Small: less than 3 billion yen; Medium: 3 to less than 10 billion yen; Large: 10 billion yen or over.

Those marked with a hyphen are not evaluated as the business impact is expected to be minimal. |

||||||||

Under the 1.5°C scenario, the major factors of profit decline are as follows: increase in transition costs (raw material costs) to low GHG-emitting raw materials, increase in taxation costs (operating costs) due to the increased introduction of carbon taxes and carbon levies, and increase in petroleum-derived raw material costs due to carbon taxes and other taxes in the upstream of the value chain passed on to raw materials.

On the other hand, we expect revenue from products contributing to the environment (PlanetFlags products) to increase due to increased demand for recycled products.

Under the 4°C scenario, the major factors of profit decline are as follows: increase in petroleum-derived raw materials procurement costs due to soaring fossil fuel prices, and damage to the company’s buildings, facilities, infrastructure, etc., plant shutdowns, and lost opportunities (decrease in revenue) due to a flood, high tide, etc. On the other hand, we expect revenue from medical-related products, from among our products contributing to human life (HumanFlags products), to increase with the increase of health damage, such as infectious diseases due to rising average temperature.

We have reviewed our responses to risks and opportunities under the respective scenarios.

Under the 1.5°C scenario, we will take the following measures to minimize risk: promote energy saving in the manufacturing process by shifting to solvent-free processes, achieve energy saving by improving infrastructure and utility efficiency, and strive to utilize fully renewable energy. Furthermore, by promoting the development of recycled materials in cooperation with our suppliers, we will reduce the usage of raw materials through the effective procurement of sustainable materials and effective utilization of resources.

These measures will enable the reduction of CO2 emissions, which will in turn enable us to mitigate the increased taxation costs by approximately 50% due to the increased introduction of carbon taxes and carbon levies by 2030. Since we expect to achieve carbon neutrality in our CO2 emissions (Scope 1+2) by 2050, we do not believe our costs will increase.

Additionally, as we can reduce our power purchases by energy saving and using renewable energy, we believe it will be possible to mitigate the increase in capital expenditures due to the development and introduction of high energy-efficient technologies by approximately 50% by both 2030 and 2050.

Under the 4°C scenario, we will take the following measures to minimize risk: reduce the usage of raw materials through the effective utilization of resources and develop preemptive prevention measures through the promotion of business continuity management (BCM) across Nitto Group business locations. We believe these measures will enable us to mitigate the increase in petroleum-derived raw materials procurement costs due to soaring fossil fuel prices, as well as the damage to the company’s buildings, facilities, infrastructure, etc., plant shutdowns, and lost opportunities due to a flood, high tide, etc. by both 2030 and 2050.

Under the 1.5°C scenario, we will work on expanding our lineup of products contributing to the environment (PlanetFlags products) in order to maximize opportunities. We expect revenue from products contributing to the environment to increase due to increased demand for low-carbon products such as recycled products.

Similarly, under the 4°C scenario, we will work on expanding our lineup of products contributing to human life (HumanFlags products). We expect revenue of medical-related products due to an increase in health damage, such as infectious diseases due to rising average temperatures.We believe we will be able to maintain a certain level of profit by consistently creating PlanetFlags and HumanFlags products.

Please see here for PlanetFlags & HumanFlags.The results of the scenario analysis have been incorporated into 2030 management indicators, including Nitto Group Carbon Neutral 2050, and into the mid-term management plan Nitto for Everyone 2025, confirming the effectiveness of the strategy.

Our 80-billion-yen investment for decarbonization over the ten-year period from 2021 to 2030 is being directed primarily to minimize the risks assumed in the 1.5°C scenario: shifting to solvent-free processes, improving infrastructure and utility efficiency, and using renewable energy. Scenario analysis has shown that these measures will enable us to save more than 10 billion yen in costs in 2030 on a single-year basis. Therefore, we believe the expected benefits make it a reasonable investment.

We consider this as validation of the resilience of our strategies for both the 1.5°C scenario and 4°C scenario, and will aim to minimize risks and maximize opportunities even further moving forward.

The Group has set “Realizing a decarbonized society” as one of its material issues for sustainability and believe that reducing GHG (CO2) emissions, a cause of global warming, is essential for a sustainable growth and the realization of a sustainable environment and society, and that it is an important social responsibility. Therefore, the Group aims to achieve carbon neutrality in our CO2 emissions (Scope 1+2) by 2050, and has declared the “Nitto Group Carbon Neutral 2050” initiative.

In addition, the Group ensures that the countermeasures are implemented to minimize risks and maximize opportunities and has established 2030 management indicators and targets to regularly monitor and manage the status of those countermeasures. The main indicators and targets, such as CO2 emissions (Scope 1+2), waste plastics recycling ratio, sustainable materials procurement ratio, and PlanetFlags and HumanFlags category revenue ratio are also set as future-financial targets that are management indicators and managed by the Group as a whole.

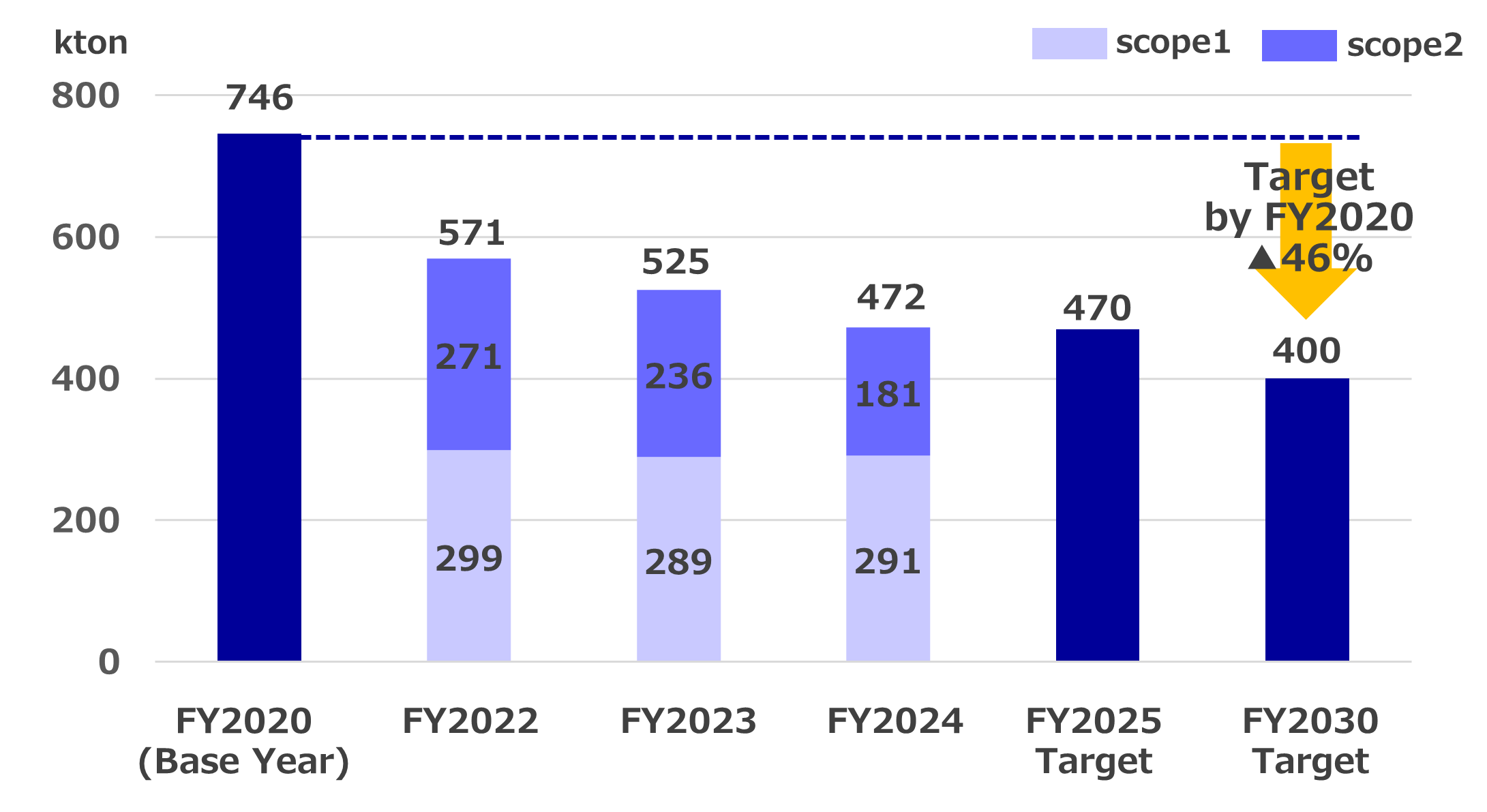

We are on track to achieve our 2030 CO2 emissions target (Scope 1+2) of 470,000 tons set in May 2022 ahead of schedule. As such, in fiscal 2024, we decided to aim to achieve 470,000 tons in 2025, and revised our 2030 target to 400,000 tons, a higher target in line with the 1.5°C target based on science*1.

In addition, we have set a new target of 1,460,000 tons of CO2 emissions (Scope 3) for 2030, and will further accelerate our activities toward realizing a decarbonized society, striving to achieve zero environmental impact not only within our own company but throughout our entire supply chain.

*1 In August 2024, we obtained SBT certification for our CO2 emissions (Scope 1+2) and (Scope 3) reduction targets.

The indicators and targets for the individual risks and opportunities by 2030 are as follows.

| Type of risk/opportunity | Event | Assumed risks and opportunities | Countermeasures | Indicators and targets | |

|---|---|---|---|---|---|

| Transition risks | Policy and laws and regulations | Strengthening of low carbon regulations | An increase in transition costs (raw material costs) to low GHG-emitting raw materials | Conversion of raw materials to alternaives, weight reduction of products

Promotion of the development of recycled materials in cooperation with suppliers |

Reduction of raw material usage

CO2 emissions (Scope 3): 1,460 kton (2030) ※SBT certified |

| A substantial increase in renewable energy procurement costs due to the spread of renewable energy | Implementation of the Domestic Renewable Energy Procurement Master Plan (stable procurement, including solar power generation system outside the premises)Promotion of PPA procurement | Renewable energy ratio: 100%

(2030: in Japan, 2035: in group-wide) *RE100 member |

|||

| An increase in capital expenditures (installation costs of renewable energy facilities) due to the spread of renewable energy | Introduction/Installation of solar power generation system on the premises (in Japan and abroad) | ||||

| An increase in GHG emission price | An increase in taxation costs (operating costs) due to the increased introduction of carbon taxes and carbon emission levies | Reduction of GHG emissions (Scope 1+2) through promoting use of renewable energy, shifting to solvent-free processes, and improving infrastructure and utility efficiency | CO2 emissions (Scope 1+2):400kton(2030)

*SBT certified |

||

| Technology | Transition to low carbon products due to investment in new technologies | A substantial increase in capital expenditures (installation costs of high-efficiency facilities) due to the development and introduction of high energy-efficient technologies | Promotion of solvent-free technology (UV, emulsion, hot-melt adhesive) Improvement of infrastructure and utility efficiency | CO2 emissions (Scope 1+2):400kton(2030)

*SBT certified |

|

| Industry/market | A substantial increase in raw material prices | An increase in petroleum-derived raw materials procurement costs due to soaring fossil fuel prices | Effective utilization of resources | Reduction of raw material usage CO2 emissions (Scope 3): 1,460 kton (2030)

*SBT certified |

|

| An increase in petroleum-derived raw material costs due to carbon taxes and other taxes in the upstream of the value chain passed on to raw materials | Effective utilization of resources Promotion of the shift from oil-based raw materials to sustainable materials (bio materials/recycled materials) | Waste plastics recycling ratio:60%(2030)Sustainable materials procurement ratio:30%(2030)

CO2 emissions (Scope 3): 1,460 kton (2030) *SBT certified |

|||

| An increase in energy prices due to soaring fossil fuel prices | Promotion of energy saving, shift to solvent-free processes, electrification | CO2 emissions (Scope 1+2):400kton(2030)

*SBT certified |

|||

| Physical risks | Acuteness | Occurrence of abnormal weather and natural disaster (acute) | Damage to the company’s buildings, facilities, infrastructure, etc., plant shutdowns, and lost opportunities (decrease in revenue) due to a flood, high tide, etc. | Promotion of business continuity management (BCM) at an individual Nitto-Group business location level | Continuous implementation of BCM at a group level and an individual business location level |

| Suspension of operation at the company’s plants, loss of opportunities (decrease in revenue) due to major suppliers being hit by a flood, high tide, etc. | Promotion of sustainable procurement (risk management) | BCP planning at partners

System to check the safety and impact of partners |

|||

| Opportunities | Products/services | An increase in demand for low-carbon products(Change in preferences) | An increase in revenue of products contributing to the environment due to increased demand for recycled products | Expansion of the PlanetFlags product lineup | PlanetFlags & HumanFlags category revenue ratio:over 50% |

| An increase in demand for medical-related products (response to infectious disease) | An increase in revenue of medical-related products due to an increase in health damage, such as infectious diseases due to rising average temperature | Expansion of the HumanFlags product lineup | PlanetFlags & HumanFlags category revenue ratio:over 50% | ||

We enhance the feasibility of the indicators and targets for each risk and opportunity by not only implementing management on a group level, but also by allocating group targets to the business execution departments, setting individual targets for each business execution department, and developing business-specific measures in addition to group-wide measures. Each business execution department confirms the progress toward target achievement monthly; the department in charge of the environment manages the progress on a group-wide basis and provides a report to the Corporate Strategy Meeting. The indicators and targets are reviewed once a year to make any necessary revisions depending on the progress status or changes in the external environment. Further, the future-financial targets are reviewed when we update the mid-term management plan once every three years, and revisions are made following review and decision by the Board of Directors.

In fiscal 2024, the CO2 emissions (Scope 1+2) amounted to 472,000 tons

We are reducing CO2 emissions and expect to achieve our 2025 target. Going forward, we will promote efforts to reduce CO2 emissions across our supply chain to achieve our new 2030 target, 400,000 tons of CO2 emissions (Scope 1+2). In May 2024, we joined Renewable Energy 100% (RE100)*2 to support the adoption of renewable energy across society and to reduce the Nitto Denko Group's CO2 emissions by transitioning the electricity used in our business activities to 100% renewable energy.

*2 We aim to achieve RE100 globally by 2035.

| Indicators | FY2020(Base Year) | FY2022 | FY2023 | FY2024 | FY2025 Target

(medium term) |

FY2030 Target

(long term) |

|---|---|---|---|---|---|---|

| CO2 emissions(Scope 1) | ー | 299kton | 289kton | 291kton | ー | ー |

| CO2 emissions(Scope 2) | 271kton | 236kton | 181kton | |||

| CO2 emissions(Scope 1+2) | 746kton | 571kton | 525kton | 472kton | 470kton | 400kton |

| Per unit of sales(Scope 1+2) | ー | 0.61Ton / Million yen | 0.57Ton / Million yen | 0.47Ton / Million yen | ー | ー |

The Nitto Group accurately calculates and reports GHG emissions in accordance with the GHG Protocol in order to identify areas in the supply chain that should be prioritized for reduction. The details of the calculation method for CO2 emissions (Scope 1+2) are as follows.

| Data(Unit) | Calculation method |

|---|---|

| CO2 emissions

Scope 1: Direct emissions Scope 2: Energy indirect emissions (kton) |

GHG emissions quantification is subject to uncertainty when measuring activity data, determining emission factors, and considering scientific uncertainty inherent in the Global Warming Potentials.

The calculation method is based on emission coefficient of “A Corporate Accounting and Reporting Standard Revised Edition” issued by The Greenhouse Gas Protocol. The emission factor is shown as below. a ) Energy (fuel, steam): Coefficient stipulated in ”Act on Promotion of Global Warming Countermeasures”b ) Energy (hot water): Emission coefficients for each supplierc ) Energy (electric power): (market) Figures of Japan, Germany indicates emission coefficients by electric power companies, And figures of Vietnam and Taiwan indicates emission coefficients by government. Other areas are calculated by regional coefficients provided by the International Energy Agency’s (IEA) CO2 Emissions from Fuel Combustion, and the United States Environmental Protection Agency’s (EPA) Emissions & Generation Resource Integrated Database (eGRID). (Location) Figures of Japan indicates Japan domestic average, figures of U.S. calculated by the United States EPA eGRID, and other areas are calculated by regional coefficients provided by IEA.d ) Materials burned by Nitto Gr. (solvent): Coefficient decided by Nitto assuming combustion reaction of solvent |

In fiscal 2024, the CO2 emissions (Scope 3) amounted to 1,966,000 tons.

We are currently considering reduction measures toward achieving our 2030 target, 1,460,000 tons of CO2 emissions (Scope 3). In particular, we are calculating the effect of reducing CO2 emissions through business portfolio reform, yield improvement, and a switch to sustainable materials while attempting to integrate the calculation into reduction measures. As cooperation from our suppliers in acquiring raw materials and managing transportation is crucial, we are actively promoting supplier engagement activities. Focusing on categories with high CO2 emissions among Scope 3, we will hold discussions with business execution departments at Global Green Committee to implement effective measures at an early stage.

Target categories: 1. Purchase of raw materials, 3. Fuel production and electricity generation, 4. Transportation (purchase and outbound logistics), 5. Waste disposal, 12. Product disposal

The details of the calculation method for CO2 emissions (Scope 3) are as follows.

| Data(Unit) | Calculation method |

|---|---|

| CO2 emissions

Scope 3: Other indirect emissions |

GHG emissions quantification is subject to uncertainty when measuring activity data, determining emission factors, and considering scientific uncertainty inherent in the Global Warming Potentials.

|

In fiscal 2024, the waste plastics recycling ratio ended up at 50%.

In order to achieve our 2030 target of a 60% waste plastic recycling ratio, we categorize waste plastics into (1) those that are easy to recycle, (2) those requiring new technological developments to enable recycling, and (3) those that are currently difficult to recycle; thus, we are establishing a recycling strategy based on each material's characteristics. Examples of (1) those that are easy to recycle include release liners used in the manufacture of tape products, which are recycled into film, spun into fibers for use of employee uniforms and eco-bags, or processed into resin pellets to create materials and reused in plastic trays. Thus, we have consistently achieved recycling results.

Going forward, we will accelerate our initiatives, particularly in fields where recycling remains challenging, and explore chemical recycling for waste that is difficult to recycle.

| Indicator | FY2022 | FY2023 | FY2024 | FY2025 Target

(medium term) |

FY2030 Target

(long term) |

|---|---|---|---|---|---|

| Waste plastics recycling ratio | 46% | 47% | 50% | 50% | 60% |

In fiscal 2024, the sustainable materials procurement ratio ended up at 18%.

To achieve our FY2025 goal of sustainable materials procurement ratio of 20%, we will continue to promote the transition to sustainable materials with the understanding and cooperation of our suppliers.

| Indicator | FY2022 | FY2023 | FY2024 | FY2025 Target

(medium term) |

FY2030 Target

(long term) |

|---|---|---|---|---|---|

| Sustainable materials procurement ratio | 17%

non-consolidated |

16%

non-consolidated |

18%

non-consolidated |

20% | 30% |

In fiscal 2024, the PlanetFlags / HumanFlags category revenue ratio ended up at 44%.

As concerns about climate change continue to grow, the development of PlanetFlags products that help address environmental issues is becoming increasingly urgent. For this to happen, we must seek collaboration with partners within and outside the company. Through the avenue of the Global Green Committee, which facilitates the decarbonization and resource recycling processes by way of technological changes, we will create new PlanetFlags products with the three axes of business divisions, regional headquarters, and functional departments cooperating organically. At the same time, we will work closely with business partners and suppliers to take diverse measures to accelerate the commercialization process, including gaining a stake in startups and venture businesses.

| Indicator | FY2022 | FY2023 | FY2024 | FY2025 Target

(medium term) |

FY2030 Target

(long term) |

|---|---|---|---|---|---|

| PlanetFlags / HumanFlags

category revenue ratio |

17% | 36% | 44% | 40% | over 50% |

Please see here for past data on our Scope 1, 2, and 3 emissions and other individual key management indicators.

The Nitto Group has implemented environmental investment based on internal carbon pricing (ICP) in order to ensure achievement of the 2030 Management Targets (CO2 emissions) committed in Nitto Group Carbon Neutral 2050. We are promoting investment, primarily in new environmental technology and facilities, at an assumed internal carbon price of 10,000 yen/t-CO2, based on consideration of EU-ETS and other external trends.